Introduction to LNG

Liquified natural gas, commonly called LNG, is primarily methane (CH4) cooled to a liquified form for transportation and storage. LNG makes it possible for natural gas to be imported and exported around the world in a safe and affordable manner. In its liquefied form, natural gas is easier to transport across vast distances because it does not require pipelines. LNG can be delivered via tanker ships, trucks, and railcars due to the fact that it takes up less space[1] than gaseous state methane.

Quick Bullets

- Natural gas remains one of the most affordable electricity generation sources.[2]

- Natural gas is the largest single source of electric power in the United States.

- LNG takes up less space, which makes it easier to transport and store.

- The United States is now the largest exporter of LNG in the world.[3]

- Presently, there are eight LNG export terminals in the United States, with three currently under construction, 12 approved but not under construction, and nine projects pending approval.[4]

- LNG export terminals could support 205,403 to 432,897 American jobs per year.

- The economic value of U.S. LNG exports ranges from $36.8 billion to $95.5 billion annually

Fracking Changes Everything: From Imports to Exports

In the early 2000s, the United States was predicted to have looming natural gas shortages. Federal policies made public lands difficult to develop for natural gas production. Moreover, production from existing wells on state and private lands was declining. Prices were high and the United States was importing LNG to satisfy growing demand.

In 2006, there were five LNG terminals in the United States[5], all designed to import LNG, with a capacity of around 4 billion cubic feet per day. At that time, 41 LNG projects were under consideration to increase U.S. import capacity. However, beginning in 2008, the fracking and shale gas revolution fueled a huge increase in natural gas production in the United States, which meant the United States no longer needed to import large amounts of LNG.

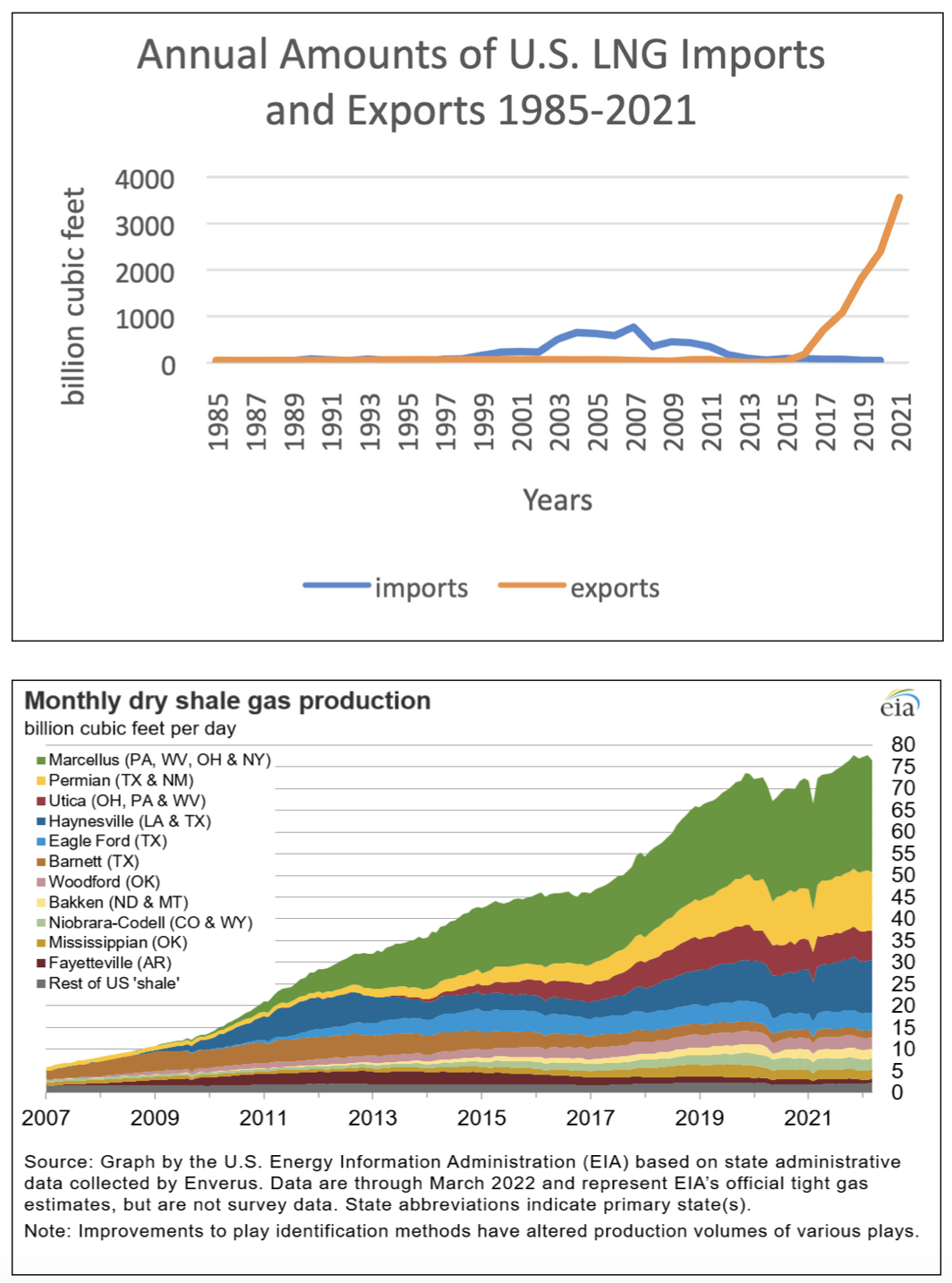

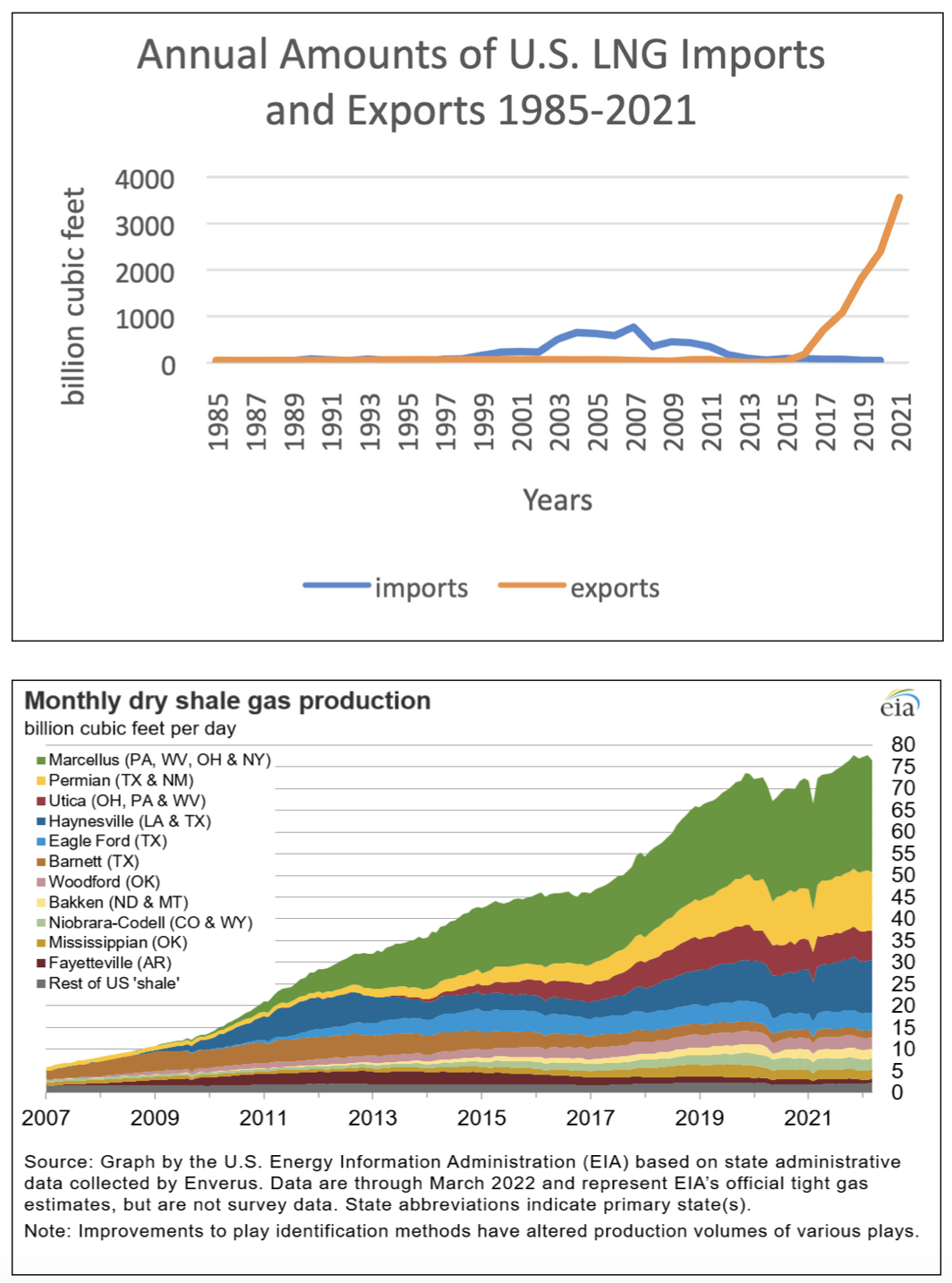

Horizontal drilling combined with fracking-improved production allowed U.S. producers to access large, untapped deposits of shale gas reserves and other unconventional formations that had previously been too difficult to access.

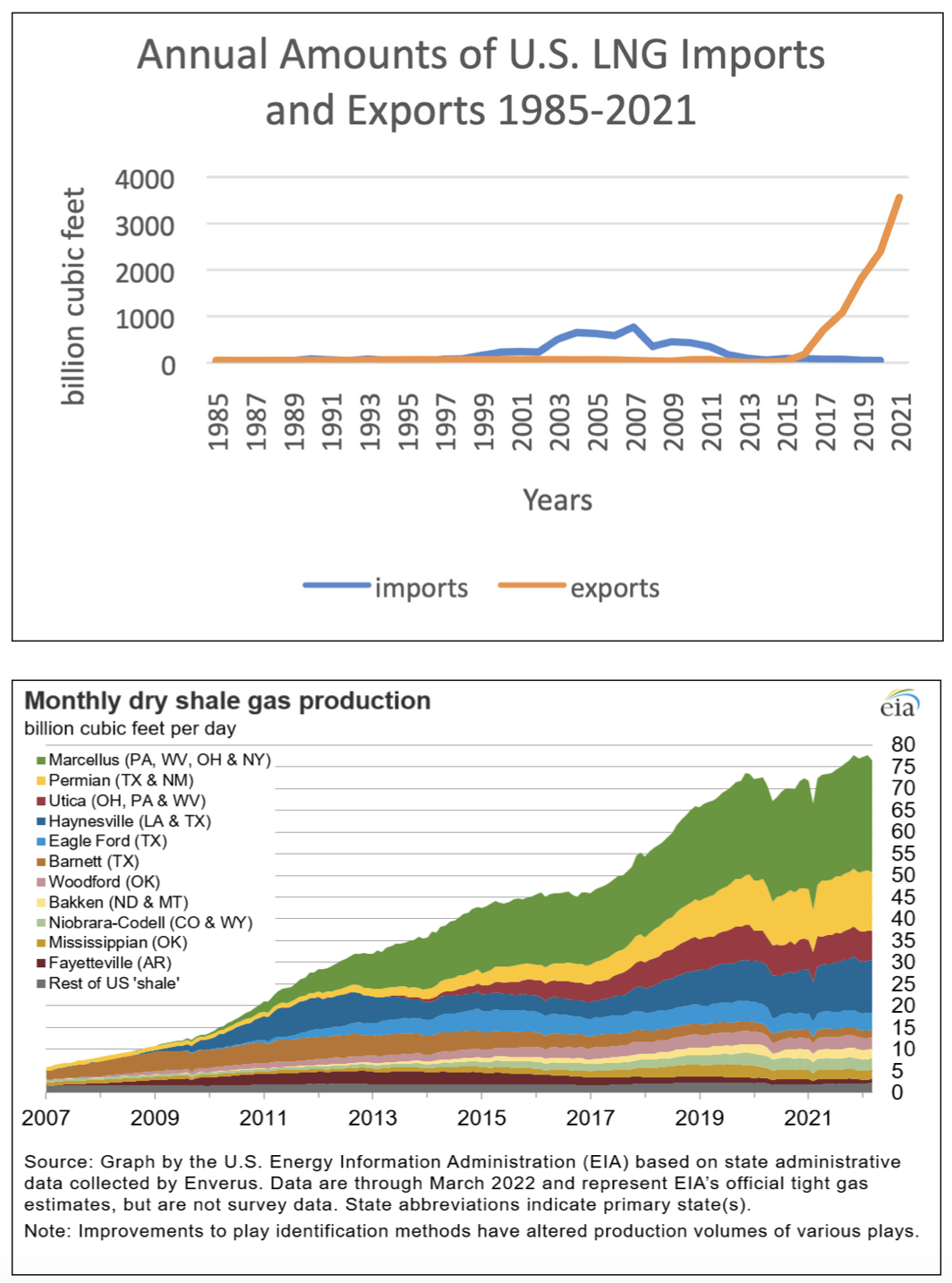

As a result, U.S. Energy Information Administration (EIA)[6] data show U.S. imports of LNG peaked in 2007, and then gradually declined. In 2005, the United States received just 4 percent of its natural gas from shale or tight gas formations[7][8]. By 2012, this increased to 20 percent. Today, it has jumped to a whopping 85 percent. What’s more, production of dry shale gas has increased from 3.69 billion cubic feet per day in January 2000 to more than 75 billion cubic feet per day in 2021.

Due to this sudden flood of supply, the price of natural gas fell precipitously after the shale gas revolution.

As natural gas supplies substantially increased due to fracking, discussions soon shifted. The conversation in America changed from the need to expand infrastructure to import natural gas to the appeal of exporting it. As such, an opportunity was created to build terminals and related infrastructure so the United States could become a chief exporter of LNG. Within years, new LNG export terminals were constructed and existing stations were converted from LNG import to export terminals. By 2017, the United States became a net LNG exporter due to the spike in U.S. natural gas production and increases in export terminal capacity.

An analysis of the economic benefits of LNG exports[9] from 2018 found that an average of 205,403 to 432,897 jobs could be created per year by the industry. Further, the study found the industry adds an economic value to the American economy of $36.8 billion to $95.5 billion annually.

Today, there are eight operating LNG export terminals in the United States, with three currently under construction, 12 approved by the Federal Energy Regulatory Commission (FERC) but not under construction, and nine projects with pending applications or in pre-filing.

Endnotes

[1] U.S. Energy Information Administration – EIA – independent statistics and analysis. Liquefied natural gas – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/energyexplained/natural-gas/liquefied-natural-gas.php

[2] U.S. Energy Information Administration – EIA – independent statistics and analysis. Electricity Data Browser. (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/electricity/data/browser/

[3] Liquefied natural gas exports continue to lead growth in U.S. Natural Gas Exports. Homepage – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/todayinenergy/detail.php?id=52118

[4] North American LNG export terminals – existing, approved not yet built, and proposed. Federal Energy Regulatory Commission. (2022, May 16). Retrieved May 20, 2022, from

https://cms.ferc.gov/media/north-american-lng-export-terminals-existing-approved-not-yet-built-and-proposed-8

[5] North American LNG outlook: Liquefied natural gas … – forest.cpast.org. (n.d.). Retrieved May 20, 2022, from

https://forest.cpast.org/Articles/fetch.adp?topicnum=101

[6] U.S. Energy Information Administration – EIA – independent statistics and analysis. Liquefied natural gas – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/energyexplained/natural-gas/liquefied-natural-gas.php

[7] Krupnick, A., Wang, Z., & Wang, Y. (2013). Sector Effects of the Shale Gas Revolution in the United States. Retrieved from,

https://media.rff.org/archive/files/sharepoint/WorkImages/Download/RFF-DP-13-21.pdf

[8] U.S. Energy Information Administration – EIA – independent statistics and analysis. Where our natural gas comes from – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/energyexplained/natural-gas/where-our-natural-gas-comes-from.php

[9] ICF International, Inc. (n.d.). Calculating the economic benefits of U.S. LNG exports. LNG Allies. Retrieved May 23, 2022, from

https://www.lngallies.com/jobs.pdf

Introduction to LNG

Liquified natural gas, commonly called LNG, is primarily methane (CH4) cooled to a liquified form for transportation and storage. LNG makes it possible for natural gas to be imported and exported around the world in a safe and affordable manner. In its liquefied form, natural gas is easier to transport across vast distances because it does not require pipelines. LNG can be delivered via tanker ships, trucks, and railcars due to the fact that it takes up less space[1] than gaseous state methane.

Quick Bullets

- Natural gas remains one of the most affordable electricity generation sources.[2]

- Natural gas is the largest single source of electric power in the United States.

- LNG takes up less space, which makes it easier to transport and store.

- The United States is now the largest exporter of LNG in the world.[3]

- Presently, there are eight LNG export terminals in the United States, with three currently under construction, 12 approved but not under construction, and nine projects pending approval.[4]

- LNG export terminals could support 205,403 to 432,897 American jobs per year.

- The economic value of U.S. LNG exports ranges from $36.8 billion to $95.5 billion annually

Fracking Changes Everything: From Imports to Exports

In the early 2000s, the United States was predicted to have looming natural gas shortages. Federal policies made public lands difficult to develop for natural gas production. Moreover, production from existing wells on state and private lands was declining. Prices were high and the United States was importing LNG to satisfy growing demand.

In 2006, there were five LNG terminals in the United States[5], all designed to import LNG, with a capacity of around 4 billion cubic feet per day. At that time, 41 LNG projects were under consideration to increase U.S. import capacity. However, beginning in 2008, the fracking and shale gas revolution fueled a huge increase in natural gas production in the United States, which meant the United States no longer needed to import large amounts of LNG.

Horizontal drilling combined with fracking-improved production allowed U.S. producers to access large, untapped deposits of shale gas reserves and other unconventional formations that had previously been too difficult to access.

As a result, U.S. Energy Information Administration (EIA)[6] data show U.S. imports of LNG peaked in 2007, and then gradually declined. In 2005, the United States received just 4 percent of its natural gas from shale or tight gas formations[7][8]. By 2012, this increased to 20 percent. Today, it has jumped to a whopping 85 percent. What’s more, production of dry shale gas has increased from 3.69 billion cubic feet per day in January 2000 to more than 75 billion cubic feet per day in 2021.

Due to this sudden flood of supply, the price of natural gas fell precipitously after the shale gas revolution.

As natural gas supplies substantially increased due to fracking, discussions soon shifted. The conversation in America changed from the need to expand infrastructure to import natural gas to the appeal of exporting it. As such, an opportunity was created to build terminals and related infrastructure so the United States could become a chief exporter of LNG. Within years, new LNG export terminals were constructed and existing stations were converted from LNG import to export terminals. By 2017, the United States became a net LNG exporter due to the spike in U.S. natural gas production and increases in export terminal capacity.

An analysis of the economic benefits of LNG exports[9] from 2018 found that an average of 205,403 to 432,897 jobs could be created per year by the industry. Further, the study found the industry adds an economic value to the American economy of $36.8 billion to $95.5 billion annually.

Today, there are eight operating LNG export terminals in the United States, with three currently under construction, 12 approved by the Federal Energy Regulatory Commission (FERC) but not under construction, and nine projects with pending applications or in pre-filing.

Endnotes

[1] U.S. Energy Information Administration – EIA – independent statistics and analysis. Liquefied natural gas – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/energyexplained/natural-gas/liquefied-natural-gas.php

[2] U.S. Energy Information Administration – EIA – independent statistics and analysis. Electricity Data Browser. (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/electricity/data/browser/

[3] Liquefied natural gas exports continue to lead growth in U.S. Natural Gas Exports. Homepage – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/todayinenergy/detail.php?id=52118

[4] North American LNG export terminals – existing, approved not yet built, and proposed. Federal Energy Regulatory Commission. (2022, May 16). Retrieved May 20, 2022, from

https://cms.ferc.gov/media/north-american-lng-export-terminals-existing-approved-not-yet-built-and-proposed-8

[5] North American LNG outlook: Liquefied natural gas … – forest.cpast.org. (n.d.). Retrieved May 20, 2022, from

https://forest.cpast.org/Articles/fetch.adp?topicnum=101

[6] U.S. Energy Information Administration – EIA – independent statistics and analysis. Liquefied natural gas – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/energyexplained/natural-gas/liquefied-natural-gas.php

[7] Krupnick, A., Wang, Z., & Wang, Y. (2013). Sector Effects of the Shale Gas Revolution in the United States. Retrieved from,

https://media.rff.org/archive/files/sharepoint/WorkImages/Download/RFF-DP-13-21.pdf

[8] U.S. Energy Information Administration – EIA – independent statistics and analysis. Where our natural gas comes from – U.S. Energy Information Administration (EIA). (n.d.). Retrieved May 20, 2022, from

https://www.eia.gov/energyexplained/natural-gas/where-our-natural-gas-comes-from.php

[9] ICF International, Inc. (n.d.). Calculating the economic benefits of U.S. LNG exports. LNG Allies. Retrieved May 23, 2022, from

https://www.lngallies.com/jobs.pdf